How Debt Resolution Works

Learn the 5 key steps to debt resolution programs so you know what to expect.

Debt resolution may not be for everyone, but it is one of the fastest ways to get out of debt. Horizon Finance Solutions provides support for debt resolution providers, including helping their clients determine if debt resolution is the right fit.

1 Consult with a debt resolution provider

This first step will determine if debt resolution is the best option for you. Your debt resolution provider should not enroll a client if it turns out another solution better suits their goals.

How do they do that? First, the debt resolution provider will review your debts and budget to see where your current finances stand. If you’re not determined to be an ideal candidate for debt resolution, you should be directed to another debt resolution option that better fits your situation.

How do they do that? First, the debt resolution provider will review your debts and budget to see where your current finances stand. If you’re not determined to be an ideal candidate for debt resolution, you should be directed to another debt resolution option that better fits your situation.

2 Set up a custom debt resolution plan

Financial situations are as unique as the people in them. That’s why it’s important to customize a resolution plan that works for your budget and goals. Your debt resolution provider can assist you in deciding the right amount of money to set aside in your budget without spreading yourself too thin.

3 Put away a small sum of money each month

Once you have settled on your monthly payments, your debt resolution provider will assist you in establishing your dedicated program account to save funds for making offers to your creditors to resolve your debts.

All situations vary. But typically, it takes from about 12 months to as much as 48 months or more to resolve all of your enrolled debts. The amount you set aside will depend on how much you owe.

All situations vary. But typically, it takes from about 12 months to as much as 48 months or more to resolve all of your enrolled debts. The amount you set aside will depend on how much you owe.

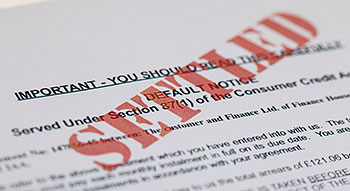

4 Resolve your debts for less than you owe

With enough funds built up in your resolution account, your debt resolution provider’s negotiators will get to work negotiating with your creditors.

Once a resolution is agreed upon, you will be contacted with an offer to settle your debt. Once you approve each debt resolution, your debt resolution provider should handle the rest of the work while updating you on the progress made.

Once a resolution is agreed upon, you will be contacted with an offer to settle your debt. Once you approve each debt resolution, your debt resolution provider should handle the rest of the work while updating you on the progress made.

5 Freedom from debt

Once your debts are resolved, it’s time to move your financial life forward. With your debts resolved, it’s more reasonable to be able to make timely payments without breaking your budget. At this point, you can take the next steps forward to a brighter financial future.